30+ Loan to value ratio calculator

Amortized Loan Formula Example 1. Or long 50 years plus.

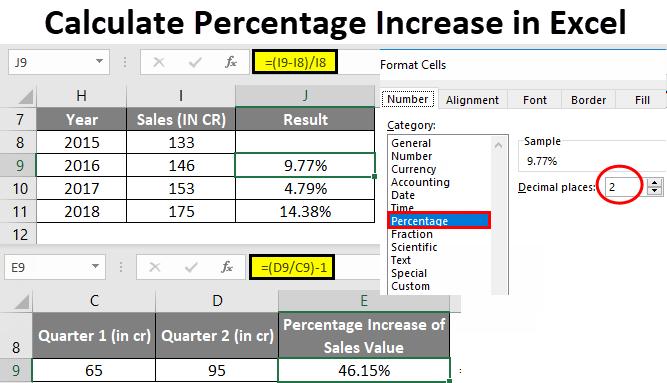

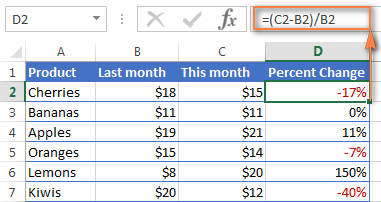

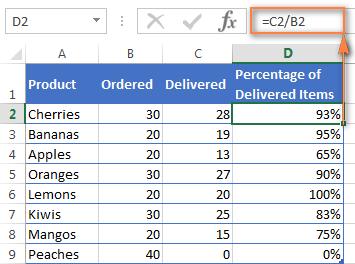

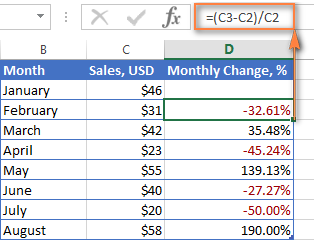

Calculate Percentage Increase In Excel Examples How To Calculate

Your LTV Ratio and Private Mortgage Insurance PMI Your loan-to-value ratio will also determine whether you have to pay private mortgage insuranceFor conventional loans borrowers who want to avoid paying private mortgage insurance will need to make a down payment of 20 percent of the value of the home.

. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. The loan-to-value ratio is the amount of the mortgage compared with the value of the property. The Loan-to-Value ratio LTV determines how much you can borrow from HDB or banks when you take a property loan.

You can use a refinance calculator. How To Calculate Loan-To-Value Ratios. Loan-to-value ratios are easy to calculate.

The higher the LTV the higher the risk that the value of the property in case of foreclosure will be insufficient to cover the remaining principal of the loan. For example if a lender grants you a 180000 loan on a home thats appraised at 200000 youll divide 180000 over 200000 to get your LTV of 90. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

How much do I need to make for a 900000 house. You can compute LTV for first and second mortgages. In the UK and US 25 to 30 years is the usual maximum.

The Dec 2021 property cooling measures in Singapore saw the LTV for HDB-granted loans lowered to 85. The first two options as their name indicates are fixed-rate loans. A photovoltaic power station also known as a solar park solar farm or solar power plant is a large-scale grid-connected photovoltaic power system PV system designed for the supply of merchant powerThey are differentiated from most building-mounted and other decentralised solar power because they supply power at the utility level rather than to a local user or users.

With a HELOC your lender will look at a combined-loan-to-value ratio CLTV where they add the amount you want to borrow with how much you owe. By the end of Year 5 the net debt-to-EBITDA ratio is marginally lower than the total debt-to-EBITDA ratio due to the diminished cash balance. You can use this formula to figure the loan-to-value ratio expressed as a percentage.

Try our Mobile Apps Android iOS. 045 percent to 105 percent depending on the loan term 15 years vs. The amortization of the loan will be in the form of equated annual repayment and.

Just divide the loan amount by the most current appraised value of the property. A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. The calculator will then reply with an income value with which you compare your current income.

Todays national mortgage rate trends. 30 years the loan amount and the initial loan-to-value ratio or LTV. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

Calculate the equity available in your home using this loan-to-value ratio calculator. Get 247 customer support help when you place a homework help service order with us. Annual mortgage insurance premium.

VA Loan Type. On Thursday September 15 2022 the national average 30-year VA loan APR is 5650. The loan to value ratio is considered an important indicator of the riskiness of a mortgage loan.

The average 30-year VA refinance APR is 5730 according to Bankrates latest survey of the nations. It is expressed as a percentage. A shorter-term loan Shorter-term home loans like 10- 15- and 20-year FRMs have lower rates than 30-year FRMs because investors dont hold the risk of carrying your debt for as long.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. 2836 are historical mortgage industry standers which are. This is a little shorter than a standard first mortgage which is 30 years.

If you get an 80000 mortgage to buy a 100000 home then the loan. For a 30-year conventional loan VA financing is a great deal. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Click the Customize button above to learn more. Typically about 10 to 20 of the propertys value.

The sharpe ratio calculator exactly as you see it above is 100 free for you to use. Loan-to-value is the homes price divided by the mortgage amount. In the drop down area you have the option of selecting a 30-year fixed-rate mortgage 15-year fixed-rate mortgage or 51 ARM.

If a home costs 250000 and you need a 210000 mortgage to purchase it your loan-to-value ratio will be 84 since youre. From 2021 to the end of 2025 the total leverage ratio increases from 40x to 48x the senior ratio increases from 30x to 36x and the net debt ratio increases from 30x to 45x. Repayment periods are usually governed by a fixed rate though variable rates can be.

The loan to value ratio calculator exactly as you see it above is 100 free for you to use. Let us take the example of a term loan with an outstanding amount of 10000 of loan that has to be repaid over the next 10 years. The VA cash-out loan allows up to a 100 percent loan-to-value ratio LTV.

Click the Customize button above to learn more. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. Malaysia home loan eligibility calculator to calculate your maximum housing loan amount in 2021 based on your annual income and ability to service the loan.

30 monthly mortgage servicing ratio. Zero low or manageable monthly debt obligations. Loan amount car value x 100 LTV So if youre borrowing 30000 to finance a car valued at 35000 the.

Remember your actual mortgage rate is based on a number of factors including your credit score and debt-to-income ratio.

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

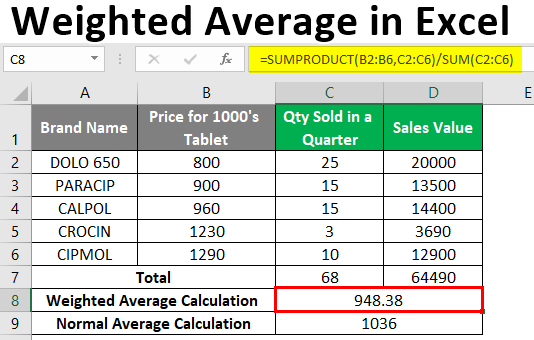

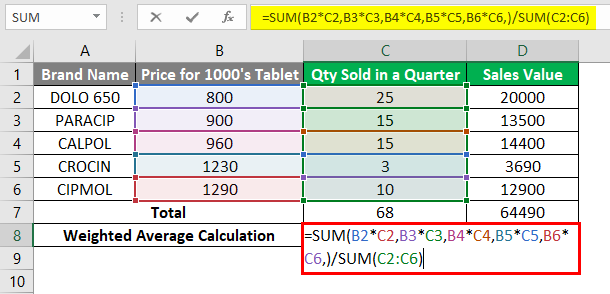

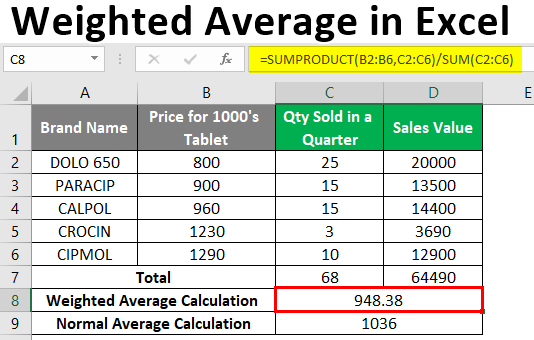

Weighted Average In Excel How To Calculate Weighted Average In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Cos 30 Degrees How To Find The Value Of Cos 30

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Tan 30 Degrees Value Unit Circle Tangent Value

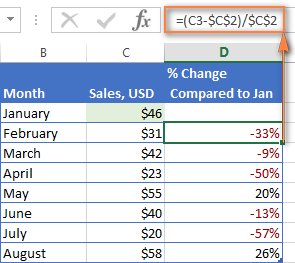

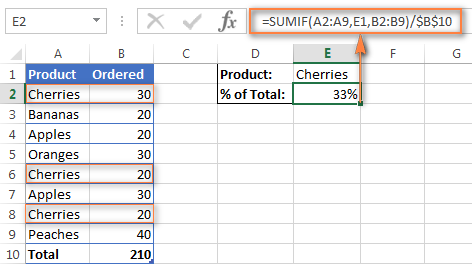

How To Calculate Percentage In Excel Percent Formula Examples

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Calculate Compound Interest In Excel How To Calculate

How To Calculate Percentage In Excel Percent Formula Examples

Lvr Calculator And What Is Loan To Value Ratio Calculate Lvr

How Can We Get The Trig Table Value Without A Calculator Is There Any Trick That Exists Quora

Weighted Average In Excel How To Calculate Weighted Average In Excel

How To Calculate Percentage In Excel Percent Formula Examples

How To Calculate Percentage In Excel Percent Formula Examples

How To Calculate Percentage In Excel Percent Formula Examples

How To Calculate Semi Annual Payment On Annual Interest Quora